What Are Spot Market Rates?

Chances are you’ve heard of spot market rates. The term has been tossed around a lot in recent years, mostly due to the increasing popularity of spot rate trucking work. Owner-operators and independent fleet owners who might have previously been avoiding the spot market in the effort to establish contract work have become more interested.

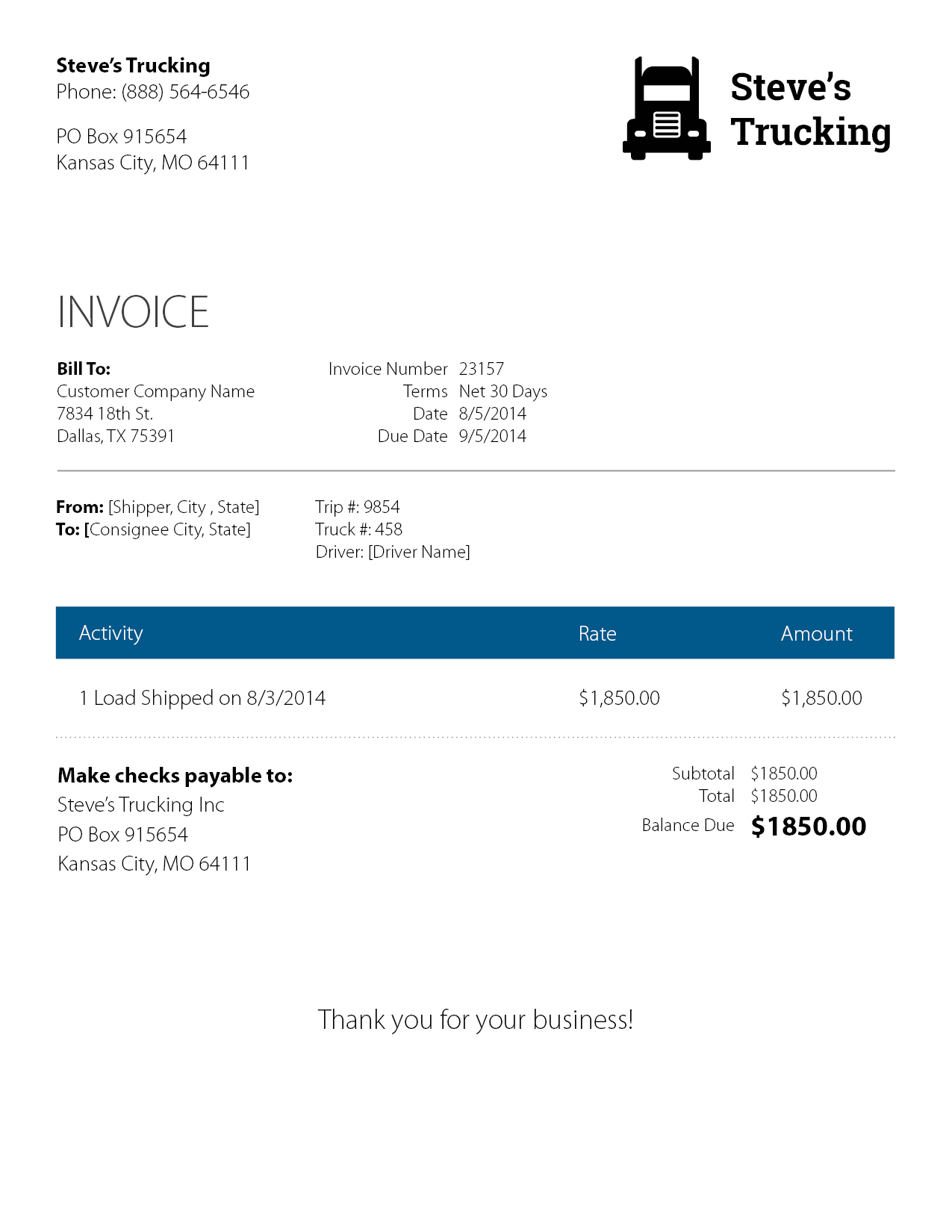

Today, most accounting software programs allow you to design your company’s invoice within minutes. Just key in some information, drop your logo into the template and you are in business. Some accounting software may not walk you through everything you need to include in your invoices, however.

Today, most accounting software programs allow you to design your company’s invoice within minutes. Just key in some information, drop your logo into the template and you are in business. Some accounting software may not walk you through everything you need to include in your invoices, however.