Companies across a wide range of industries are turning to invoice factoring to gain access to working capital fast.

What is invoice factoring? Also known as accounts receivable financing, it’s a service that allows you to submit your company’s unpaid invoices and receive funding in 24 hours or less. This process enables your business to quickly build cash flow, instead of waiting several weeks or months for customers to pay.

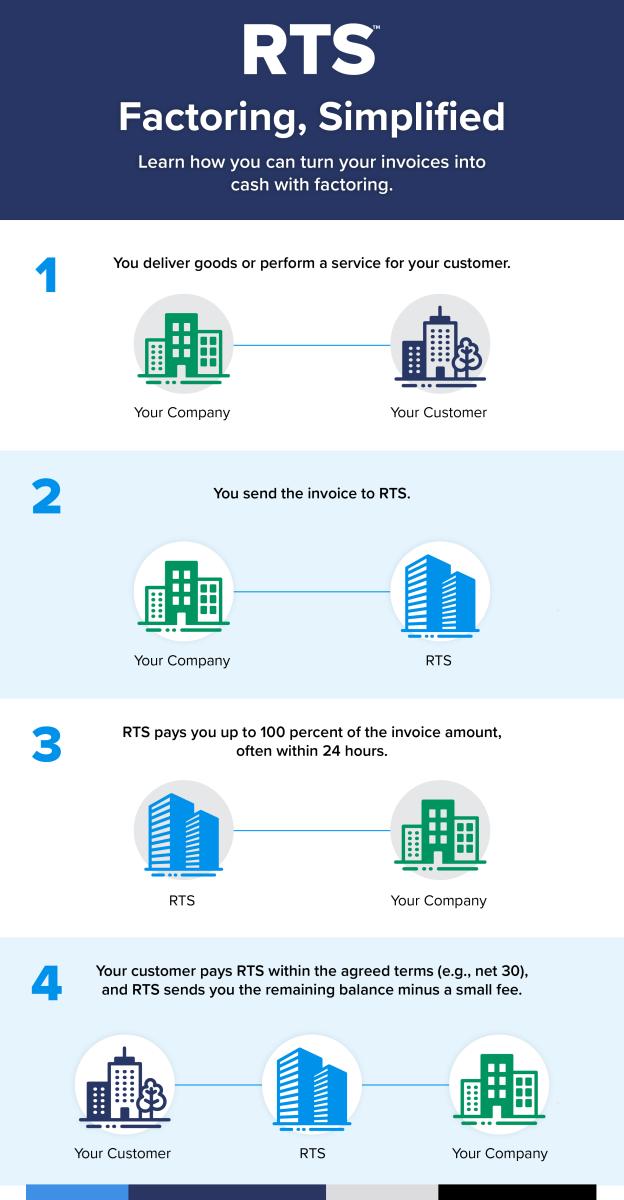

Having cash on hand allows businesses to better manage their day-to-day operations, prepare for emergencies and even plan for future growth. But how does it actually work? This illustration details the simple, step-by-step process you can expect when working with an invoice factoring company like RTS.